The Liberian economy is characterized by its reliance on natural resources, agriculture, and a burgeoning service sector. Historically, Liberia has been rich in minerals such as iron ore, gold, and diamonds, which have played a significant role in its economic development. The country’s economy has faced numerous challenges, including the impacts of civil conflict, fluctuating commodity prices, and the global economic environment.

In recent years, however, there has been a concerted effort to stabilize and grow the economy through various reforms and investments in infrastructure. Agriculture remains a cornerstone of the Liberian economy, employing a significant portion of the population. The sector is diverse, encompassing crops such as rice, cassava, and palm oil.

Despite its potential, agricultural productivity has been hampered by inadequate infrastructure, limited access to markets, and the effects of climate change. The government and various NGOs are working to enhance agricultural practices and improve food security, which is crucial for the overall economic stability of the nation. Additionally, the service sector is gradually expanding, driven by telecommunications and banking services, which are essential for fostering economic growth and improving the quality of life for Liberians.

Key Takeaways

- The Liberian economy is heavily reliant on agriculture, mining, and foreign aid, with a high unemployment rate and low GDP per capita.

- Setting financial goals is crucial for individuals in Liberia to plan for their future and work towards achieving financial stability.

- Creating a budget helps individuals in Liberia track their income and expenses, prioritize spending, and save for long-term goals.

- Investing in Liberia can be done through various avenues such as stocks, real estate, and small business ventures, but it requires careful research and consideration of risks.

- Saving for the future is essential for individuals in Liberia to build an emergency fund, save for education, and plan for retirement.

- Managing debt is important for individuals in Liberia to avoid high interest payments and maintain a good credit score.

- Protecting assets in Liberia can be done through insurance, estate planning, and diversification of investments.

- Seeking professional financial advice from experts in Liberia can provide individuals with personalized guidance and strategies for managing their finances effectively.

Setting Financial Goals

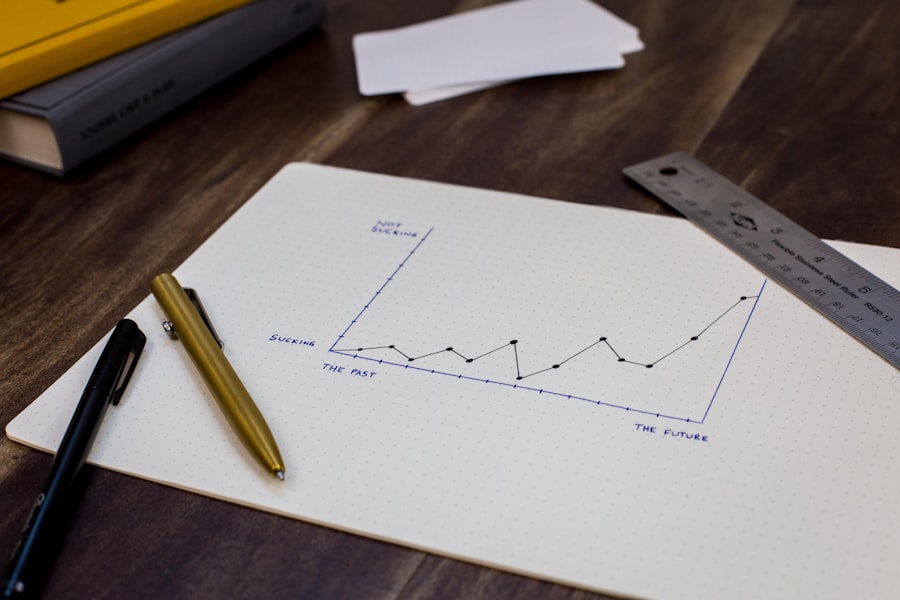

Establishing clear financial goals is a fundamental step in achieving financial stability and success. In Liberia, where economic conditions can be unpredictable, having well-defined objectives can provide direction and motivation. Financial goals can range from short-term aspirations, such as saving for a new appliance or paying off a small debt, to long-term ambitions like purchasing a home or funding a child’s education.

By categorizing these goals into short-term, medium-term, and long-term, individuals can create a structured approach to their finances. To effectively set financial goals, it is essential to consider one’s current financial situation and future aspirations. This involves assessing income sources, expenses, and existing debts.

For instance, if an individual aims to save for a home within five years, they must evaluate their monthly savings capacity and identify areas where they can cut back on discretionary spending. Additionally, utilizing the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—can help in formulating realistic goals that are easier to track and achieve. By setting these benchmarks, individuals can maintain focus and make informed decisions about their financial journeys.

Creating a Budget

Creating a budget is a vital component of personal finance management that allows individuals to track their income and expenses systematically. In Liberia, where many people may not have formal banking relationships or access to financial literacy resources, budgeting can be particularly beneficial. A well-structured budget provides clarity on spending habits and helps identify areas where savings can be made.

It serves as a roadmap for financial decision-making and can significantly reduce the stress associated with managing money. To create an effective budget, one must first gather all relevant financial information, including income from various sources such as salaries, business profits, or remittances. Next, it is crucial to categorize expenses into fixed costs—such as rent or utilities—and variable costs—like groceries or entertainment.

By analyzing these categories over time, individuals can pinpoint unnecessary expenditures and adjust their spending habits accordingly. For example, if someone discovers they are spending excessively on dining out, they might choose to allocate more funds toward savings or debt repayment instead. Regularly reviewing and adjusting the budget ensures that it remains aligned with changing financial circumstances and goals.

Investing in Liberia

| Investment Sector | Opportunities | Challenges |

|---|---|---|

| Agriculture | Rich soil for crop cultivation | Infrastructure limitations |

| Mining | Abundance of natural resources | Regulatory uncertainty |

| Tourism | Beautiful beaches and wildlife | Security concerns |

Investing in Liberia presents both opportunities and challenges for individuals looking to grow their wealth. The country’s natural resources offer potential for lucrative investments in sectors such as mining and agriculture. However, investors must navigate a landscape marked by regulatory complexities and infrastructural deficits.

Understanding the local market dynamics is crucial for making informed investment decisions. For instance, investing in agricultural ventures could yield significant returns given Liberia’s fertile land and favorable climate conditions; however, investors must also consider factors such as access to markets and supply chain logistics. In addition to traditional investment avenues like real estate or stocks, there is a growing interest in microfinance and small business development in Liberia.

Many entrepreneurs are seeking capital to start or expand their businesses, creating opportunities for investors willing to provide funding in exchange for equity or interest payments. This not only supports local economic growth but also fosters innovation and job creation within communities. Engaging with local business networks can provide valuable insights into emerging sectors and help investors identify promising opportunities that align with their financial goals.

Saving for the Future

Saving for the future is an essential practice that enables individuals to build financial security and prepare for unforeseen circumstances. In Liberia, where economic volatility can impact livelihoods, having a savings plan is particularly important. Establishing an emergency fund that covers three to six months’ worth of living expenses can provide a safety net during challenging times.

This fund can be used for unexpected medical expenses or job loss, ensuring that individuals do not fall into debt when faced with financial emergencies. In addition to emergency savings, individuals should consider setting aside funds for specific future goals such as education or retirement. In Liberia’s context, where formal retirement systems may be limited or non-existent for many workers, personal savings become even more critical.

Utilizing savings accounts offered by local banks or community savings groups can help individuals grow their savings over time through interest accumulation. Moreover, adopting a habit of saving regularly—whether through automatic transfers or setting aside a portion of income each month—can significantly enhance one’s ability to reach financial goals.

Managing Debt

Debt management is a crucial aspect of personal finance that requires careful planning and discipline. In Liberia, many individuals may rely on loans for various purposes—such as education, business expansion, or home purchases—making it essential to understand how to manage these obligations effectively. High-interest rates on loans can quickly lead to financial strain if not handled properly.

Therefore, it is vital to prioritize debt repayment strategies that minimize interest costs while ensuring timely payments. One effective approach to managing debt is the snowball method, where individuals focus on paying off smaller debts first while making minimum payments on larger ones. This strategy can provide psychological benefits by creating a sense of accomplishment as debts are eliminated one by one.

Alternatively, the avalanche method targets debts with the highest interest rates first, potentially saving money in the long run. Regardless of the chosen strategy, maintaining open communication with creditors can also be beneficial; negotiating payment terms or seeking assistance during difficult times can prevent defaults and preserve creditworthiness.

Protecting Your Assets

Asset protection is an often-overlooked aspect of personal finance that involves safeguarding one’s wealth from potential risks such as theft, natural disasters, or legal claims. In Liberia’s context, where property rights may not always be clearly defined or enforced, understanding how to protect assets becomes paramount. Individuals should consider obtaining insurance coverage for valuable possessions such as homes or vehicles to mitigate potential losses due to unforeseen events.

Additionally, diversifying investments can serve as a protective measure against market volatility. By spreading investments across different asset classes—such as real estate, stocks, or agricultural ventures—individuals can reduce their exposure to risk associated with any single investment type. Furthermore, establishing legal structures such as trusts or limited liability companies can provide additional layers of protection for personal assets against creditors or legal disputes.

Seeking Professional Financial Advice

Navigating the complexities of personal finance in Liberia can be daunting; therefore, seeking professional financial advice is often a prudent step for individuals looking to enhance their financial literacy and decision-making capabilities. Financial advisors can provide tailored guidance based on individual circumstances and goals while helping clients understand investment opportunities available within the local context. In Liberia’s evolving economic landscape, professionals with expertise in local markets can offer invaluable insights into emerging trends and potential risks associated with various investment strategies.

Whether it involves retirement planning, tax optimization strategies, or investment diversification techniques, professional advice can empower individuals to make informed choices that align with their long-term financial objectives. Engaging with certified financial planners or reputable institutions can foster greater confidence in managing finances effectively while navigating the unique challenges posed by Liberia’s economic environment.